Short-term promissory notes

The Manitoba Hydro-Electric Board

The Manitoba Hydro-Electric Board, also referred to as Manitoba Hydro, (the “Corporation”) was established as an agent of the Crown in right of the Province of Manitoba by an Act of the Provincial Legislature passed in 1949 and now operates under The Manitoba Hydro Act. The intent, purpose and object of the corporation as stated in the Act is “to provide for the continuance of a supply of power adequate for the needs of the province, and to engage in and to promote economy and efficiency in the development, generation, transmission, distribution, supply and end-use of power.” The Corporation’s head office is located in the City of Winnipeg, Province of Manitoba, Canada.

Description of Short-Term Promissory Notes

Principal Amount:

The principal amount of short-term promissory notes (the “Notes”) outstanding at any one time shall not exceed in the aggregate the sum of $500,000,000.00 in Canadian and/or United States funds and/or equivalent Canadian funds in other foreign currencies.

Form:

Canada: Notes will be issued in the name of The Manitoba Hydro-Electric Board and registered in the nominee name of The Canadian Depository for Securities Limited. (“CDS & Co.”) on behalf of its participants in its Debt Clearing Service. The Notes may be issued as interest bearing Notes or as non-interest bearing Notes at a discount. No physical Notes will be issued or delivered. A Note will be held by the Issuing Agent, as Safekeeper on behalf of CDS & Co. Each issuance and placement of Notes is recorded by means of electronic book-entry.

The book-entry Notes will be subject to the Depository Bills and Notes Act (Canada).

United States: Notes will be issued in the name of The Manitoba Hydro-Electric Board and registered in the nominee name of The Depository Trust Company (“DTC.”). The Notes may be issued as interest bearing Notes or as non-interest bearing Notes at a discount. No physical Notes will be issued or delivered. The Master Note will be held by the Issuing Agent, as Custodian, on behalf of DTC. Each issuance and placement of Notes is recorded by means of electronic book-entry.

The book-entry Notes will be subject to the Uniform Commercial Code of the United States, as revised.

Maturities:

Canada: Notes issued will not exceed one year from the respective dates of issue.

United States: Notes issued will not exceed nine months from the respective dates of issue.

Issuing and Paying Agent:

Canada: Canadian Imperial Bank of Commerce (“CIBC”), Main Offices in Toronto.

United States: Bank of New York, 101 Barclay Street, New York, NY 10286

Payment and Delivery:

Canada: Same day delivery will be made to the purchaser or his agent against payment in Toronto of immediately available funds.

At maturity, payment will be made on behalf of the Corporation through CIBC of immediately available funds.

United States: Same day delivery will be made to the purchaser or his agent against payment in New York by interbank wire transfer (Fedwire) of immediately available funds.

At maturity, payment will be made on behalf of the Corporation through the Bank of New York by interbank wire transfer (Fedwire) of immediately available funds.

Rating:

Notes are rated A-1+ by Standard & Poor’s and P-1 by Moody’s Investors Service.

Guarantee:

The Notes of the Corporation are unconditionally guaranteed as to principal and interest, if any, by the Government of Manitoba.

Bank Lines of Credit:

The Corporation maintains bank lines of credit in Canadian and United States funds and liquid assets in amounts which, at all times in its opinion, will be sufficient to meet the payment of outstanding Notes.

Non-Resident Tax:

There are no withholding taxes payable under the laws of Canada or of the Province of Manitoba in respect of the Notes or the interest thereon, if any, by owners who are non-residents of Canada; there are no other income taxes or capital gains taxes payable under the laws of Canada or of the Province of Manitoba in respect of the Notes or the interest thereon, if any, by owners who are non-residents of Canada who do not use or hold the Notes in carrying on business in Canada.

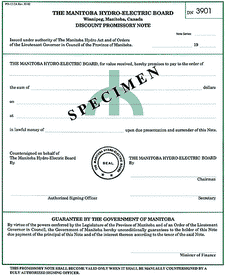

Specimen note – discount promissory note.

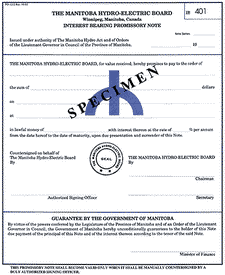

Specimen note – interest bearing promissory note.

Enlarge image: Specimen note – interest bearing promissory note.

Eligibility:

As outlined and qualified in the opinions of counsel, which opinions form part of this Information Memorandum, the Notes are eligible investments under:

- Insurance Companies Act (Canada)

- Trust and Loan Companies Act (Canada)

- Pension Benefits Standards Act (Canada)

- Loan and Trust Corporations Act (Ontario)

- Insurance Act (Ontario)

- Pension Benefits Act (Ontario)

Order in Council

The Manitoba Hydro-Electric Board Order of the Lieutenant Governor in Council Authorizing Increase in Short-Term Borrowing Limits

Order in Council No. 815

On Matters of State

To The Honourable the Lieutenant Governor in Council

The undersigned, the Minister of Finance, submits for approval of Council a report setting forth that:

WHEREAS “The Manitoba Hydro Act” provides in part as follows:

“30(1) With the approval of the Lieutenant Governor in Council, the corporation may, from time to time, borrow or raise money for temporary purposes by way of overdraft, line of credit, or loan ,or otherwise upon the credit of the corporation in such amounts, not exceeding in the aggregate the sum of $500,000,000.00 of principal outstanding at any one time, upon such terms, for such periods, and upon such other conditions, as the corporation may determine.

30(2) The government may, on such terms as may be approved by the Lieutenant Governor in Council, guarantee the payment of the principal and interest on any borrowings of the corporation under this section.

30(3) Where the corporation borrows or raises money under this section, otherwise than

- by way of overdraft with a bank; or

- by sale of its short term notes to a bank in lieu of borrowing by overdraft;

it shall do so only with the prior approval of the Minister of Finance, who, at the request of the corporation, may act as its agent in that behalf;”

AND WHEREAS The Manitoba Hydro-Electric Board (herein referred to as the “corporation”) by resolution dated August 20, 1992, a certified copy of which is annexed hereto as Schedule “A”; deems it necessary to borrow or raise money from time to time for its temporary purposes in amounts not exceeding in the aggregate the sum of $500,000,000 of principal outstanding at any one time and requests approval of the Lieutenant Governor in Council of such temporary borrowing authority;

AND WHEREAS the corporation by the aforementioned resolution dated August 20, 1992, has also requested the Government of Manitoba to unconditionally guarantee the due and punctual payment of the principal and interest on Promissory Notes to be issued by the corporation pursuant to the Legislative authority hereinbefore set out;

AND WHEREAS it is presently deemed advisable to authorize the Minister of Finance on behalf of the government to guarantee the due and punctual payment of the principal and interest on the Promissory Notes issued by the corporation pursuant to the Legislative authority hereinbefore set out;

THEREFORE he, the Minister, recommends:

- THAT approval be given to the borrowing or raising of money by the corporation from time to time, for its temporary purposes by way of overdraft, line of credit, or loan or otherwise, upon the credit of the corporation in such amounts, not exceeding in the aggregate the sum of $500,000,000 of principal outstanding at any one time, upon such terms, for such periods and upon such other conditions, as the corporation may determine.

- THAT the Minister of Finance, on behalf of the government, be authorized to guarantee the due and punctual payment of the principal and interest on Promissory Notes to be issued by the corporation from time to time, for its temporary purposes not exceeding in the aggregate the sum of $500,000,000 of principal outstanding at any one time.

- THAT the guarantee herein authorized be endorsed on the aforesaid Promissory Notes in the following form and manner:

Guaranteed by the Government of Manitoba

By virtue of the powers conferred by the Legislature of the Province of Manitoba and of an Order of the Lieutenant Governor in Council, the Government of Manitoba hereby unconditionally guarantees to the holder of this Note due payment of the principal of this Note and of the interest thereon according to the tenor of the said Note.

Minister of Finance

and be signed as to any or all of the said Promissory Notes by the Minister of Finance holding office at the date hereof or on any date thereafter, and that the signature of the Minister of Finance may be engraved, lithographed, printed or otherwise mechanically reproduced and when mechanically reproduced as aforesaid shall be conclusively deemed, for all purposes, the signature of the Minister of Finance and shall be binding upon the Government of Manitoba notwithstanding that the person whose signature is so reproduced may not have held office at the date of the said Promissory Notes or at the date of delivery thereof and notwithstanding that the person who holds such office at the time such signature is affixed is not the person who holds that office at the date of the said Promissory Notes or at the date of the delivery thereof, and that such form and manner of guarantee be approved.

Signature

![]()

In the Executive Council Chamber, Winnipeg

Upon consideration of the foregoing report and recommendation Council advises that it be done as recommended.

September 16, 1992

At Government House in the City of Winnipeg

Approved and Ordered this 16th day of September A.D. 1992

Legal Opinions – Canadian

July 31, 2000

The Manitoba Hydro-Electric Board

820 Taylor Avenue

Winnipeg MB R3C 2P4

Dear Sirs:

Re:

Issue of Short Term Promissory Notes

Our Matter No. 0053037 GWA

We understand that The Manitoba Hydro-Electric Board (the “Corporation”) proposes to borrow or raise money from time to time for temporary purposes under the authority of Section 30 of The Manitoba Hydro Act (the “Act”) by way of the issue and sale of short term promissory notes guaranteed as to principal and interest, if any (the “Guarantee”) by the Government of Manitoba (the “Notes”), the Notes to be issued in principal amounts of not less than $100,000.00 or multiples thereof to a maximum of $500,000,000 and to be issued and sold in Canada for terms not to exceed one year from the respective dates of issue thereof and/or to be issued and sold in the United States for terms not to exceed nine months from the respective dates of issue thereof.

You have requested our opinion in connection with the issue by the Corporation from time to time of the Notes and in that regard, we have examined the following:

- The Manitoba Hydro Act, Revised Statutes of Manitoba, 1987, c.H-190, as amended;

- Insurance Companies Act (Canada), Statutes of Canada 1991, c.47, as amended;

- Trust and Loan Companies Act (Canada), Statutes of Canada 1991, c.45, as amended;

- Pension Benefits Standards Act, 1985 (Canada), Revised Statutes of Canada, 1985, c.32 (2nd Supp.), as amended;

- Income Tax Act (Canada), Revised Statutes of Canada, 1952, c.148, as amended;

- Copy of a Resolution passed by the Board of the Corporation on August 25, 1992, certified on July 31, 2000 as being in full force and effect;

- Copy of a Resolution passed by the Board of the Corporation on August 20, 1998, certified on July 31, 2000 as being in full force and effect;

- Certified copy of Order of the Lieutenant Governor in Council of the Province of Manitoba No. 815/1992, certified on July 31, 2000;

- Form of discount promissory note and form of interest bearing promissory note to be used in the issue and sale of the Notes;

- Information Memorandum of the Corporation, dated July 31, 2000 regarding the issue of the Notes;

- Opinion of Torys, Ontario special counsel, dated July 31, 2000 and opinions of counsel in the Provinces and Territories of Canada other than Manitoba and Ontario.

Based upon, subject to and relying on the foregoing, we are of the opinion that:

- The Corporation is a duly constituted and existing Corporation under the laws of the Province of Manitoba and is an agent of the Crown in right of the Province of Manitoba;

- The Corporation has the legal capacity and authority to issue, from time to time, the Notes, not to exceed, in the aggregate, the principal amount outstanding at any one time of $500,000,000 in Canadian or U.S. funds and/or in any other currency of any country not exceeding, in the aggregate, an amount of principal outstanding at any time equivalent to $500,000,000 in Canadian funds as calculated in the manner prescribed in Section 35 of the Act, and all necessary actions have been duly taken by the Corporation and all necessary authorizations and approvals under the laws of the Province of Manitoba have been duly obtained for the authorization, execution, issuance, sale and delivery of the Notes;

- Each of the Notes, when issued in either of the two forms set forth in the Corporation’s Information Memorandum and when signed manually or by facsimile signature by the Chairman and the Secretary of the Corporation, as authorized for that purpose by Resolution of the Board of the Corporation, and when manually countersigned by an officer appointed by the Corporation for that purpose, (the President and Chief Executive Officer, Vice-President, Finance and Chief Financial Officer, Treasurer or Treasury Officer of the Corporation, or any person duly appointed for that purpose by a chartered bank or trust company authorized by the Corporation to act as an agent of the Corporation for the purposes of issuing and paying the Notes, and each of them, being an authorized signing officer for that purpose) and when delivered by or on behalf of the Corporation for value, will constitute a legal, valid and binding obligation of the Corporation, and when bearing the Guarantee by the Government of Manitoba (the “Government”) of the payment of the principal thereof and the interest thereon, if any, signed by the Minister of Finance of the Province of Manitoba as provided in Order of the Lieutenant Governor in Council No. 815/1992, will constitute a legal, valid and binding obligation of the Government. The giving of the Guarantee endorsed on each of the Notes has been duly authorized under the laws of the Province of Manitoba and the Order of the Lieutenant Governor in Council of the Province applicable thereto;

- No filing or registration is necessary in order for the Corporation to offer, sell and distribute the Notes to the public in any of the Provinces or Territories of Canada, except that in the Province of Quebec, any disclosure document must be filed without delay with the Quebec Securities Commission;

- In the Province of British Columbia, if the recipient of the Notes is an individual, the Notes must have, at the date of sale, a credit rating equal to or higher than P-1 from Moody’s Investors Service, Inc., A-1 from Standard & Poor’s Corporation, A-1 (low) from Canadian Bond Rating Services Inc., or R-1-L from Dominion Bond Rating Services Limited;

- As at the date hereof, the Notes are eligible investments in which, subject to general investment provisions, conditions and restrictions pertaining generally to purchasers or to a specific purchaser:

- the provisions of the Insurance Companies Act (Canada) and the Regulations thereunder would not, subject to compliance with the prudent investment standards and the investment policies, standards and procedures contemplated by such Act, preclude funds of an insurance company governed by such Act from being invested;

- the provisions of the Trust and Loan Companies Act (Canada) and the Regulations thereunder would not, subject to compliance with the prudent investment standards and the investment standards, policies and procedures contemplated by such Act, preclude funds of a company, as defined in and governed by such Act, from being invested;

- by virtue of Section 9(3)(d) of Schedule III to the Regulations enacted pursuant to the Pension Benefit Standards Act, 1985 (Canada), the funds of a pension plan whose investment powers are determined by Schedule III of the said Regulations may be invested;

- the provisions of the Loan and Trust Corporations Act (Ontario) and the Regulation thereunder would not, subject to compliance with the prudent investment standards of the Act, preclude the funds received as deposits by registered corporations (as defined in that Act) from being invested;

- by virtue of Section 433(1)(a) and Section 434 of the Insurance Act (Ontario), an insurer incorporated or organized under the laws of Ontario may, under such Act, and without resorting to the provisions of Section 433(4) thereof, invest its funds; and

- the provisions of the Pension Benefits Act (Ontario) and the Regulation thereunder would not preclude the funds of a pension plan regulated thereunder from being invested, provided that:

- if the plan administrator is investing the assets of the plan in accordance with such Regulation as it read on December 30, 1999, the Notes are within a category or sub-category of investment that is specifically permitted by, and for which guidelines are established in, the statement of investment policies and goals for such plan filed under that Act, and provided further that such investment is in compliance with the prudent investment standards of that Act; or

- if the plan administrator is investing the assets of the plan in accordance with sections 6, 7, 7.1, and 7.2 and Schedule III to the Regulation under the Pension Benefits Standards Act, 1985 (Canada) as it read on December 31, 1999, as incorporated by reference into the Regulation under the Pension Benefits Act (Ontario), the investment by such plan in the Notes adheres to the investment criteria established thereunder, and provided further that such investment is in compliance with the prudent investment standards of the Pension Benefits Act (Ontario);

- There are no withholding taxes payable under the laws of Canada or of the Province of Manitoba in respect of the Notes or the interest thereon, if any, by owners who are non-residents of Canada; there are not other income taxes or capital gains taxes payable under the laws of Canada or of the Province of Manitoba in respect of the Notes or the interest thereon, if any, by owners who are non-residents of Canada who do not use or hold the Notes in carrying on business in Canada.

Our opinion expressed herein is given on the basis of the laws as they exist on the date hereof. We assume no responsibility to update our opinion if the laws are, subsequent to the date hereof, amended, revoked, revised or supplemented in any way which impacts on the opinion contained herein.

Yours very truly,

![]()

Legal opinions - U.S.

July 31, 2000

The Manitoba Hydro-Electric Board,

P.O. Box 815-STN Main,

Winnipeg, Manitoba R3C 2P4,

Canada.

Ladies and Gentlemen:

We have acted as special United States counsel for The Manitoba Hydro-Electric Board (“Manitoba Hydro”) in connection with the proposed issuance and sale by Manitoba Hydro of its short-term promissory notes in maturities not exceeding nine months (the “Notes”), bearing the guarantees (the “Guarantees”) of the Government of Manitoba (the “Government”) and being delivered pursuant to a letter agreement, dated October 17, 1983 (the “Agency Agreement”), between Manitoba Hydro and The Bank of New York (the “Agent”). In such capacity we have examined such documents and such questions of United States Federal and New York law as we have considered necessary or appropriate for the purposes of this opinion, and on the basis of the foregoing, we advise you that, in our opinion:

- The Agency Agreement has been duly authorized, executed and delivered and constitutes a valid and legally binding agreement of Manitoba Hydro.

- The Notes have been duly authorized and, when executed, countersigned and delivered against payment in accordance with the Agency Agreement, will constitute valid and legally binding obligations of Manitoba Hydro.

- The Guarantees have been duly authorized and, when endorsed on Notes duly delivered against payment in accordance with the Agency Agreement, will constitute valid and legally binding obligations of the Government.

Our opinion contained in paragraphs (2) and (3) above is subject to the qualification that the aggregate principal amount of Notes outstanding at any one time shall not exceed $500,000,000 in Canadian and/or U.S. funds and/or equivalent Canadian funds in other foreign currencies.

In rendering the foregoing opinion, to the extent that it involves matters governed by the laws of Canada and Manitoba, we have relied on the opinion, dated the date hereof, of Thompson, Dorfman, Sweatman, special counsel to Manitoba Hydro. We have also assumed that the signatures on all documents examined by us are genuine.

A copy of this opinion may be delivered to Moody’s Investors Service, Inc., Standard & Poor’s Corporation and The Bank of New York, each of which may rely hereon as if this opinion were addressed to it individually.

Very truly yours,

![]()

July 31, 2000

The Manitoba Hydro-Electric Board,

P.O. Box 815-STN Main,

Winnipeg, Manitoba R3C 2P4,

Canada.

Ladies and Gentlemen:

We have acted as special United States counsel for The Manitoba Hydro-Electric Board (“Manitoba Hydro”) with respect to the proposed issuance and sale by Manitoba Hydro of short-term promissory notes (the “Notes”) bearing the guarantees (the “Guarantees”) of the Government of Manitoba (the “Guarantor”).

You have requested our opinion regarding the availability of an exemption for the Notes and the Guarantees from the registration requirements of the United States Securities Act of 1933, as amended (the “Securities Act”), and from the requirement to qualify an indenture with respect to the Notes and the Guarantees under the United States Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”). We have been advised by you and understand that the Notes will be issued under the circumstances, and subject to the conditions, set forth below.

The Notes will be bought and resold by dealers and investment bankers as principals (or in some instances sold through them acting as agents) and will be offered and sold by them solely to institutional investors and other entities and individuals who normally purchase commercial paper in large denominations. The maturity of the Notes offered or sold in the United States will not be more than nine months from the date of issuance. Notes with maturities exceeding nine months may be offered or sold outside the United States, but will not be offered or sold to any investor within the United States, including by means of any general solicitation or advertising. The Notes will not contain any provision for extension or automatic roll-over, either at the option of the holder or the option of Manitoba Hydro. The Notes will be issued in bearer form or registered in the name of the holder and will be interest bearing with principal and interest payable at maturity or issued at a discount to mature at the principal amount. The Notes will be issued in multiples of $100,000 in Canadian and/or U.S. funds and/or equivalent Canadian funds in other foreign currencies at the time of issue. All Notes issued by Manitoba Hydro will be rated in one of the highest two categories by at least one nationally recognized rating organization. The aggregate principal amount of Notes outstanding at any one time shall not exceed the lesser of $500,000,000 in Canadian and/or U.S. funds and/or equivalent Canadian funds in other foreign currencies and the amount determined in accordance with the formula described below (computed at the date of issuance of a Note). Manitoba Hydro will maintain lines of credit, in Canadian and U.S. funds, and liquid assets in amounts which, at all times in its opinion, will be sufficient to meet the payment of outstanding Notes.

Prospective purchasers will be furnished an information memorandum containing certain summary information regarding Manitoba Hydro and the Guarantor.

The proceeds from the sale of the Notes will be added to the general funds of Manitoba Hydro which are utilized to meet a variety of cash expenditure requirements. Thus, it will normally not be possible to identify the use of the proceeds from the Notes with specific transactions. However, Manitoba Hydro will limit the issuance of the Notes so that the amount of Notes outstanding at any particular time will not exceed the sum of its:

- bank balances and temporary investments of duration less than one year;

- accounts receivable, accrued revenue and other current assets;

- interest receivable;

- materials and supplies;

- depreciation charges for the preceding fiscal year;

- general operating and administrative expenses, such as salaries, pension payments and other wage-related expenditures and

- water rentals of a term less than one year for the preceding fiscal year.

For purposes of applying this limitation formula, amounts in Canadian dollars will be translated into U.S. dollars at the noon spot exchange rate on the date of determination for U.S. dollars against Canadian dollars quoted by the Bank of Canada.

As of March 31, 2000, the latest date for which audited financial information is available, and for the period then ending, the total amount available under the above formula was approximately Canadian $890,000,000. Converted into U.S. dollars at the noon spot exchange rate for U.S. dollars against Canadian dollars quoted by the Bank of Canada on March 31, 2000 (U.S. $0.6880 per Canadian dollar), this would equal approximately U.S. $612,000,000. Accordingly, the aggregate principal amount of Notes outstanding on that date would have been restricted to U.S. $500,000,000.

On the basis of the foregoing, relying upon representations from Manitoba Hydro and our understandings referred to above, we are of the opinion that

- the Notes and the Guarantees offered in the United States will constitute exempt securities under Section 3(a)(3) of the Securities Act,

- the Notes and the Guarantees may be offered outside the United States in the manner contemplated above in reliance on Regulation S under the Securities Act and

- consequently registration of the Notes and the Guarantees under the Securities Act is not required in order that the Notes may be sold in the manner contemplated above nor is the qualification of an indenture with respect thereto required under the Trust Indenture Act.

You are authorized to deliver copies of this opinion to Moody’s Investors Service, Inc., Standard & Poor’s Corporation and The Bank of New York, each of which may rely upon this opinion as if it were addressed to them.

Very truly yours,

![]()

Guarantor

Province of Manitoba

General information

The Province of Manitoba is located in the center of Canada, north of the States of Minnesota and North Dakota. It is the most easterly of the three Provinces of Manitoba, Saskatchewan and Alberta, which together constitute the Prairie Region of Canada. Manitoba is bounded on the east by the Province of Ontario, on the north by Hudson Bay and the Territory of Nunavut, and on the west by the Province of Saskatchewan. The Province has 400 miles of northern coastline bordering on Hudson Bay. The only seaport in the Prairie Region is located at Churchill on Hudson Bay.

Of Manitoba’s total area of 251,000 square miles, 39,000 square miles are lakes and rivers and 163,000 square miles are lands owned by the Province. Cultivated land comprises 30,000 square miles in the southern part of the Province. The northern half of the Province, which is part of the Canadian Shield, is composed largely of timberlands and extensive areas of mineralized rock structure.

The estimated population of Manitoba on July 1, 1999 was 1,143,400, of whom approximately 680,000 lived in Winnipeg, the capital of the Province. Winnipeg has a diversified economic base with significant activity in a variety of manufacturing and service sectors. The city is also a major rail, truck and air transportation hub by virtue of its geographical position in the center of the continent. The second largest city in the Province is Brandon, with a population of approximately 40,000. Brandon, in western Manitoba, is a major supply center for the agriculture industry, as well as an agriculture-related manufacturing center.

The economy

General

The Manitoba economy shares many characteristics with the overall Canadian economy. Like Canada, the Province has a diversified economy with major industries of manufacturing, agriculture, metal mining, transportation, communication and wholesale trade. Similarly, the Province exports a large portion of production.

In 1998, Real Gross Domestic Product increased 3.2% compared to the increase of 3.1% Canada as a whole experienced. Gross Domestic Product at factor cost has continued to rise at a steady pace over the last 5 years to a level of $26.5 billion in 1998. There was growth of 1.2% in non-commercial services (ie. health care, education and public administration) while commercial services lead by retail and wholesale trade and finance experienced considerable growth of 4.8%. Goods production increased 5.0% owing to increases in manufacturing (7.9%), construction (3.9%), utilities (2.6%) and mining (4.5%). In the first nine months of 1999, the value of manufacturing shipments decreased 2.4% compared to the first nine months of 1998. The decrease is principally due to a 36.7% reduction in machinery shipments largely associated with reduced shipments of agricultural machinery. Overall, ten of sixteen categories of manufacturing reported increases.

Over the five years 1994 to 1998, exports to the United States and other countries increased by 86.0% and 53.8% (representing compound annual growth rates of 16.8% and 11.4%). Merchandise exports amounted to $17.0 billion in 1998, an increase of 7.5% compared to 1997. International trade agreements and changes in currency exchange rates have had a positive impact on exports. Total foreign exports for the first eight months of 1999 were down .9% compared to the first eight months of 1998. On a year-to-date basis, exports to the United States have increased by approximately 28.2%.

Farm cash receipts decreased by 6.1% in 1998 primarily due to a decline in receipts from wheat, but were still the second highest in history. Cash receipts are diversified between crops and livestock and within these major sectors of production.

In 1998, estimated tourism expenditures by both residents of Manitoba and visitors increased by 19.5% to $971 million. In the summer of 1999, Winnipeg hosted the Pan American Games.

Average employment in 1998 increased .01% to 546,100 and Manitoba’s average unemployment rate decreased from 6.6% to 5.7%. The employment rate is at the lowest level since 1980, significantly lower than the Canadian unemployment rate of 8.3%.

The following table sets forth selected indicators of economic activity and the compound annual growth rates for the Province and Canada for the years 1994 through 1998. In this table and throughout this document, compound annual growth rates are calculated by distributing the aggregate amount of growth during the period on the basis of a constant annual rate of growth compounded annually.

| Economic indicator | Year ended December 31, | Compound annual growth rate | ||||

|---|---|---|---|---|---|---|

| 1994 | 1995 | 1996 | 1997 | 1998 | ||

| (in millions of dollars unless otherwise indicated) | 1994–1998 | |||||

| Nominal gross domestic product 1 Manitoba | $26,169 | $27,382 | $28,830 | $29,923 | $30,686 | 4.1% |

| Canada | 767,506 | 807,088 | 833,921 | 873,947 | 895,704 | 3.9 |

| Real gross domestic product 2 Manitoba | 25,363 | 25,927 | 26,630 | 27,827 | 28,715 | 3.2 |

| Change | 3.8% | 2.2% | 2.7% | 4.5% | 3.2% | — |

| Canada | 748,350 | 769,082 | 782,130 | 813,031 | 838,265 | 2.9 |

| Change | 4.7% | 2.8% | 1.7% | 4.0% | 3.1% | — |

| Personal income | 22,682 | 23,622 | 24,625 | 24,895 | 25,967 | 3.4 |

| Personal income per capita (in dollars) | 20,181 | 20,825 | 21,667 | 21,875 | 22,710 | 3.0 |

| Retail sales | 7,020 | 7,432 | 7,920 | 8,589 | 8,772 | 5.7 |

| Capital investment | 3,554 | 3,814 | 3,978 | 4,882 | 5,181 | 9.9 |

| Housing starts (units) | 3,197 | 1,963 | 2,318 | 2,612 | 2,895 | −2.5 |

| Change in Consumer Price Index Manitoba | 1.4% | 2.7% | 2.2% | 2.2% | 1.3% | — |

| Canada | 0.2% | 2.2% | 1.6% | 1.6% | 1.0% | — |

| Population (July 1) (in thousands) Manitoba | 1,124 | 1,130 | 1,134 | 1,137 | 1,138 | 0.3 |

| Canada | 29,036 | 29,354 | 29,672 | 30,008 | 30,297 | 1.1 |

| Employment (in thousands) | 511.1 | 521.4 | 525.5 | 538.3 | 546.1 | 1.6 |

| Average unemployment rate | 9.2% | 7.5% | 7.5% | 6.6% | 5.7% | — |

| Average exchange rate (C$ per U.S.$) | 1.3659 | 1.3726 | 1.3636 | 1.3844 | 1.4831 | — |

|

||||||

In the Spring of 1997, the Red River Valley in southern Manitoba experienced its most severe flooding in this century. Although the flood adversely affected many homes, farms and businesses, the overall impact on the provincial economy was negligible.

Economic structure

The Province has a diversified economy. In 1998, agriculture accounted for 3.3% of Gross Domestic Product at factor cost, mining, forestry and utility industries for 6.3%, manufacturing for 13.4% and construction for 5.0%. The commercial service sector accounted for 50.5% of gross domestic product at factor cost, and the non-commercial service sector for 21.6%.

The following table sets forth the Gross Domestic Product by industry at factor cost and the compound annual growth rates for the years 1994 through 1998.

| Domestic product | Year ended December 31, | Compound annual growth rate | ||||

|---|---|---|---|---|---|---|

| 1994 | 1995 | 1996 | 1997 | 1998 | ||

| (in millions of dollars unless otherwise indicated) | 1994–1998 | |||||

| Goods producing industries - manufacturing | $2,623 | $2,888 | $3,039 | $3,352 | $3,554 | 7.9% |

| Construction | 1,144 | 1,152 | 1,190 | 1,300 | 1,332 | 3.9 |

| Utilities | 901 | 930 | 976 | 1,000 | 1,000 | 2.6 |

| Agriculture 2 | 877 | 804 | 1,318 | 992 | 872 | −0.1 |

| Mining | 490 | 560 | 545 | 634 | 584 | 4.5 |

| Forestry | 72 | 84 | 81 | 73 | 76 | 1.4 |

| Total goods producing industries | 6,107 | 6,417 | 7,149 | 7,351 | 7,418 | 5.0 |

| Service producing industries, commercial services, real estate | 2,654 | 2,712 | 2,772 | 2,895 | 2,994 | 3.1 |

| Transportation and storage | 1,474 | 1,541 | 1,586 | 1,742 | 1,720 | 3.9 |

| Retail trade | 1,334 | 1,388 | 1,462 | 1,572 | 1,689 | 6.1 |

| Wholesale trade | 1,173 | 1,295 | 1,385 | 1,499 | 1,564 | 7.5 |

| Finance and insurance | 1,148 | 1,120 | 1,200 | 1,331 | 1,434 | 5.7 |

| Communication | 1,009 | 1,013 | 1,017 | 1,047 | 1,032 | 0.6 |

| Other commercial services | 2,291 | 2,442 | 2,592 | 2,757 | 2,954 | 6.6 |

| Total commercial services | 11,083 | 11,511 | 12,014 | 12,843 | 13,387 | 4.8 |

| Non-commercial services, hospitals and welfare | 1,923 | 1,962 | 1,990 | 1,982 | 2,064 | 1.8 |

| Education | 1,592 | 1,596 | 1,601 | 1,613 | 1,648 | 0.9 |

| Federal administration | 955 | 954 | 926 | 900 | 902 | −1.4 |

| Provincial administration | 582 | 589 | 587 | 604 | 621 | 1.6 |

| Local administration | 404 | 430 | 441 | 460 | 483 | 4.6 |

| Total non-commercial services | 5,456 | 5,531 | 5,545 | 5,559 | 5,718 | 1.2 |

| Total service producing industries | 16,536 | 17,042 | 17,558 | 18,402 | 19,105 | 3.7 |

| Gross domestic product (at factor cost) | $22,643 | $23,460 | $24,707 | $25,753 | $26,524 | 4.0 |

|

||||||

Public debt

Debt record

The Province has always paid the full face amount of the principal of and premium and interest on (a) every direct obligation issued by it and (b) every indirect obligation on which it has been required to implement its guarantee, all promptly when due in the currency in which and country where payable at the time of payment thereof, subject during wartime to any applicable laws and regulations forbidding trading with the enemy.

Direct funded debt of the Province

The Province borrows to fund its net cash requirement. The following table summarizes the direct funded debt of the Province by currency as at March 31 for the years 1995 through 1999.

| Direct funded debt | As at March 31, | ||||

|---|---|---|---|---|---|

| 1995 | 1996 | 1997 | 1998 | 1999 1 | |

| (in thousands of dollars) | |||||

| Direct funded debt payable in 2: Canadian dollars 3 | $7,456,145 | $7,710,108 | $7,913,617 | $8,575,028 | $10,175,179 |

| Issues swapped to Canadian dollars | 2,042,156 | 1,951,919 | 2,930,815 | 2,746,411 | 2,045,427 |

| U.S. Dollars | 6,541,383 | 6,312,647 | 5,337,523 | 4,895,424 | 5,517,267 |

| Issues swapped to U.S dollars | 1,177,203 | 1,020,128 | 885,139 | 1,363,002 | 880,384 |

| Total direct funded debt 4 | 17,216,887 | 16,994,802 | 17,067,094 | 17,579,865 | 18,618,257 |

| Less: sinking funds | 3,442,245 | 3,833,016 | 4,529,727 | 5,053,335 | 5,821,697 |

| Net direct funded debt | $13,774,642 | $13,161,786 | $12,537,367 | $12,526,530 | $12,796,560 |

| Raised for the purpose of general government programs 5 | $7,364,197 | $6,813,637 | $6,807,955 | $6,763,278 | $6,773,800 |

| The Manitoba Hydro-Electric Board | 4,492,814 | 4,605,587 | 4,526,062 | 4,784,110 | 5,083,853 |

| Other | 1,917,631 | 1,742,562 | 1,203,350 | 979,142 | 938,907 |

| Net direct funded debt | $13,774,642 | $13,161,786 | $12,537,367 | $12,526,530 | $12,796,560 |

|

|||||

Guaranteed debt of the Province

The following table summarizes the guaranteed debt of the Province by currency and purpose of issue as at March 31 for the years 1995 through 1999.

| Guaranteed debt | As at March 31, | ||||

|---|---|---|---|---|---|

| 1995 | 1996 | 1997 | 1998 | 1999 | |

| (in thousands of dollars) | |||||

| Guaranteed debt payable in 1 Canadian dollars | $803,193 | $649,868 | $560,033 | $507,565 | $479,632 |

| U.S. dollars | $195,580 | $210,478 | $601,893 | $532,500 | $296,709 |

| Total guaranteed debt | $998,773 | $860,346 | $1,161,926 | $1,040,065 | $776,341 |

| Less: sinking funds and other related trust funds | $129,186 | $137,985 | $147,897 | $248,916 | $175,118 |

| Net guaranteed debt 2 | $869,587 | $722,361 | $1,014,029 | $791,149 | $601,223 |

| Issued by The Manitoba Hydro-Electric Board | $842,441 | $694,541 | $1,005,601 | $784,689 | $592,600 |

| Other | $27,146 | $27,820 | $8,428 | $6,460 | $8,623 |

| Net guaranteed debt 2 | $869,587 | $722,361 | $1,014,029 | $791,149 | $601,223 |

|

|||||

Maturity schedule

The following table sets forth the maturity schedule by currency of the direct funded and guaranteed debt of the Province as at March 31, 1999:

| Years ending March 31, | Maturity schedule direct and guaranteed debt 1 | ||||

|---|---|---|---|---|---|

| Canadian dollars 2 | U.S. dollars 2 3 | Gross maturities | Estimated sinking funds withdrawal | Net maturities | |

| (in thousands of dollars) | |||||

| Short-term debt | $335,098 | $296,709 | $631,807 | $200,695 | $431,112 |

| 2000 | 1,120,738 | 197,215 | 1,317,953 | 255,679 | 1,062,274 |

| 2001 | 1,825,617 | 536,905 | 2,362,522 | 743,533 | 1,618,989 |

| 2002 | 696,389 | 1,207,360 | 1,903,749 | 520,166 | 1,383,583 |

| 2003 | 1,124,927 | 1,111,198 | 2,236,125 | 674,719 | 1,561,406 |

| 2004 | 833,892 | 932,892 | 1,766,784 | 433,342 | 1,333,442 |

| 5,936,661 | 4,282,279 | 10,218,940 | 2,828,134 | 7,390,800 | |

| 2005–2009 | 3,595,802 | 374,659 | 3,970,461 | 793,863 | 3,176,598 |

| 2010–2014 | 1,266,121 | — | 1,266,121 | 368,054 | 898,067 |

| 2015–2019 | 1,001,712 | 754,600 | 1,756,312 | 170,186 | 1,586,126 |

| 2020-2031 | 899,945 | 1,282,820 | 2,182,765 | 1,836,578 | 346,187 |

| $12,700,241 | $6,694,358 | $19,394,599 | $5,996,815 | $13,397,784 | |

|

|||||

Sinking funds

A revised Financial Administration Act, which was proclaimed in force April 1, 1997, eliminated the requirement for the sinking fund allocation by the Province. The Minister of Finance may now provide for the creation and management of sinking funds for the orderly retirement of debt. The Minister of Finance may authorize, by directive, the amount, if any, to be allocated to the Province’s sinking fund. The amount allocated to the sinking fund by the Province for the fiscal year ended March 31, 1999, was $301.2 million. Currently, the Province’s sinking fund is invested principally in securities issued or guaranteed by Canadian provinces.

The terms of the Provincial statute incorporating Manitoba Hydro requires the corporation to provide, prior to its fiscal year end in each year, amounts for sinking funds which are not less than the sum of (a) 1% of the debt of and Provincial advances to the corporation outstanding at the preceding fiscal year end plus (b) 4% of the balance of cash and book value of securities in the sinking fund at such date. Interest earned on money and securities in the sinking fund is paid to the corporation.

Unfunded debt

The unfunded debt of the Province as at March 31, 1999 amounted to $1,072 million, including $322 million of accounts payable, $320 million of accrued interest and $430 million of other accrued charges. This unfunded debt was offset by current assets of the Province in the amount of $799 million, represented by $296 million of March 1999 tax revenue receivables, $38 million of other receivables, $100 million of interest receivable and $142 million of accounts receivable from the Federal and other governments and $223 million in cash and equivalents.

Consolidated funded debt of the Manitoba public sector

The Province supervises all financial activities of the Manitoba public sector. Certain public sector entities issue debt in their own names, which is not guaranteed by the Province. Accordingly, not all funding within the public sector is reflected in the Province’s financial statements. The following table sets forth the consolidated funded debt of the Manitoba public sector at March 31 for each of the years 1995 through 1999.

| Consolidated funded debt | As at March 31, | ||||

|---|---|---|---|---|---|

| 1995 | 1996 | 1997 | 1998 | 1999 | |

| (in millions of dollars) | |||||

| Issued for the purpose of general government programs | $9,497 | $9,279 | $9,350 | $9,305 | $9,733 |

| The Manitoba Hydro-Electric Board | 5,895 | 5,944 | 6,314 | 6,719 | 7,009 |

| Other crown organizations | 2,991 | 2,813 | 2,753 | 2,809 | 2,872 |

| Municipalities and their enterprises | 1,125 | 1,197 | 1,162 | 1,240 | 1,199 |

| Schools and universities | 336 | 352 | 355 | 352 | 376 |

| Hospitals and associated institutions | 707 | 707 | 601 | 526 | 527 |

| Total public sector debt | 20,551 | 20,292 | 20,535 | 20,951 | 21,716 |

| Less: accumulated sinking funds | 3,853 | 4,307 | 5,013 | 5,639 | 6,367 |

| Net public sector debt | $16,698 | $15,985 | $15,522 | $15,312 | $15,349 |

| Consisting of direct debt of the Province 1 | $17,217 | $16,995 | $17,067 | $17,579 | $18,619 |

| Less: Amount provided to Municipalities and Universities | 56 | 54 | 43 | 33 | 24 |

| Guaranteed debt of the Province 1 | 999 | 860 | 1162 | 1,040 | 776 |

| Less: amount provided to municipalities, schools and hospitals | 4 | 1 | 1 | — | — |

| Non-guaranteed debt of crown organizations | 233 | 237 | 233 | 247 | 243 |

| Less: amount provided to municipalities and hospitals | 6 | 1 | 1 | — | — |

| Municipalities and their enterprises | 1,125 | 1,197 | 1,162 | 1,240 | 1,199 |

| Schools and universities | 336 | 352 | 355 | 352 | 376 |

| Hospitals and associated institutions | 707 | 707 | 601 | 526 | 527 |

| Total public sector debt | 20,551 | 20,292 | 20,535 | 20,951 | 21,716 |

| Less: accumulated sinking funds | 3,853 | 4,307 | 5,013 | 5,639 | 6,367 |

| Net public sector debt | $16,698 | $15,985 | $15,522 | $15,312 | $15,349 |

|

|||||

Selected debt information

The following table sets forth certain information as to the funded debt of the Province as well as debt issued for general government programs (all net of accumulated sinking funds) as at March 31 for the years 1995 through 1999, including per capita data based upon population at July 1 of the preceding calendar year:

| Public sector debt | As at March 31, | ||||

|---|---|---|---|---|---|

| 1995 | 1996 | 1997 | 1998 | 1999 | |

| Total net consolidated funded debt of the Manitoba public sector (in millions) | $16,698 | $15,985 | $15,522 | $15,312 | $15,349 |

| Per capita | 14,856 | 14,146 | 13,688 | 13,467 | 13,488 |

| As a percent of personal income | 73.6% | 67.7% | 63.0% | 61.5% | 59.1% |

| As a percent of gross domestic product | 63.8% | 58.4% | 53.8% | 51.2% | 50.0% |

| Total net direct funded debt of the Province (in millions) | $13,775 | $13,162 | $12,537 | $12,527 | $12,797 |

| Per capita | 12,255 | 11,648 | 11,056 | 11,018 | 11,245 |

| As a percent of personal Income | 60.7% | 55.7% | 50.9% | 50.3% | 49.3% |

| As a percent of gross domestic product | 52.6% | 48.1% | 43.5% | 41.9% | 41.7% |

| Net debt issued for general government programs (in millions) | $7,364 | $6,814 | $6,808 | $6,763 | $6,774 |

| Per capita | 6,552 | 6,030 | 6,004 | 5,948 | 5,953 |

| As a percent of personal income | 32.5% | 28.8% | 27.6% | 27.2% | 26.1% |

| As a percent of gross domestic product | 28.1% | 24.9% | 23.6% | 22.6% | 22.1% |

| Net cost of servicing general government program debt as a percent of provincial revenue | 10.8% | 9.8% | 9.8% | 8.9% | 8.5% |

Revenue and expenditure

Under the Constitution, the Province has the power to impose direct taxation within the Province in order to raise revenue for Provincial purposes. It also has exclusive jurisdiction over the borrowing of money on the sole credit of the Province.

Under the statutes of the Province, public money is deposited to the credit of the Minister of Finance and forms part of the Consolidated Fund of the Province. Money necessary to carry out the operations of the Province in each fiscal year is voted by the Legislative Assembly, with the exception of those expenditures for which provision has already been made by special legislation, such as amounts required to service the debt of the Province and to fulfill guarantees made by the Province. In addition, the Lieutenant Governor in Council may, when the Legislative Assembly is not in session, authorize expenditures that are urgently and immediately required for the public good through the issuance of special warrants.

The financial transactions of the Province are recorded in the Consolidated Fund. The Consolidated Fund reflects the transactions and balances of the Operating Fund, which records the operations of the Province, the Trust Fund, which records the trust administration fund, and other special funds of the Province.

The annual financial statements prepared for the Operating Fund report amounts received as Provincial revenue, amounts expended on Provincial programs as Provincial expenditure, amounts lent and invested, and amounts borrowed and repaid. The annual financial statements prepared for the Trust Fund report the activities relating to the trust money administered by the Province. The Trust Fund is primarily comprised of cash and investments of Crown corporations, agencies, boards and commissions on deposit with the Minister of Finance. All short-term investments are made in the Operating Fund. The accounts and financial statements of the Province are examined by the Provincial Auditor who is responsible to the Legislative Assembly and is required to make a report to the Legislative Assembly each fiscal year.

The accounts of the Province are kept on an accrual basis. Interest on borrowed funds as well as interest earnings on investments are accrued. Revenue from shared-cost agreements with Federal governments is also accrued. Fluctuations in the value of direct funded debt payable in foreign currencies, debt discounts and premiums and investment discounts and premiums are amortized over the life of the debt or investment.

The accounts of the Consolidated Fund of the Province include investments in, and loans, advances and grants to, Crown organizations and Government enterprises, but in general do not include the profits or losses of such entities. Each of these entities maintains its own accounting records, which are audited annually. The accounts do not include revenue and expenditure of local government bodies such as municipalities and school boards which carry out certain responsibilities delegated by the Province, except that Provincial assistance provided to such entities is included in the Provincial accounts as expenditure.

The Provincial Government prepares a budget for each fiscal year, which estimates revenue and expenditure. In 1989, a Fiscal Stabilization Fund was established to cushion fluctuations in Provincial revenue and provide a more stable basis for fiscal decisions. The Fund is also available for special initiatives. The Fiscal Stabilization Fund earns interest. Transfers to and from the Fiscal Stabilization Fund are determined by the Minister of Finance, subject to approval by the Lieutenant Governor in Council. At March 31, 1999, the Fiscal Stabilization Fund had $427.3 million in liquid assets. Beginning in the 1996/97 fiscal year, all proceeds from lotteries are drawn into revenue on a current basis.

The following table sets forth the transactions of the Operating Fund for the four fiscal years ended March 31, 1999 and the budget estimate for the fiscal year ending March 31, 2000.

| Statement of operating fund transactions | Year ending March 31, | |||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1996 | 1997 | 1998 | 1999 | Budget Estimate 2000 | ||||||||||||||||||||||||||||

| (in millions of dollars) | ||||||||||||||||||||||||||||||||

| Revenue 1 individual and corporation income taxes | $1,492.5 | $1,653.2 | $1,623.8 | $2,022.4 | $1,851.3 | |||||||||||||||||||||||||||

| Federal transfers unconditional | 1,503.4 | 1,672.7 | 1,668.3 | 1,427.8 | 1,600.2 | |||||||||||||||||||||||||||

| Conditional (shared costs) | 369.4 | 43.2 | 215.8 | 131.8 | 122.9 | |||||||||||||||||||||||||||

| Other corporation taxes | 331.5 | 353.0 | 370.9 | 383.1 | 394.7 | |||||||||||||||||||||||||||

| Sales taxes | 779.5 | 819.7 | 881.9 | 938.0 | 964.9 | |||||||||||||||||||||||||||

| Gasoline and motive Fuel taxes | 216.7 | 218.6 | 218.1 | 224.4 | 223.7 | |||||||||||||||||||||||||||

| Luxury taxes | 405.1 | 472.7 | 482.5 | 491.8 | 484.0 | |||||||||||||||||||||||||||

| Natural resources revenue | 121.3 | 100.7 | 118.1 | 86.9 | 86.9 | |||||||||||||||||||||||||||

| Other revenue | 208.0 | 165.2 | 162.5 | 175.8 | 170.4 | |||||||||||||||||||||||||||

| Total revenue before transfer from fiscal stabilization fund and lotteries fund | 5,427.4 | 5,499.0 | 5,741.9 | 5,882.0 | 5,899.0 | |||||||||||||||||||||||||||

| Transfer from fiscal stabilization fund | — | — | 100.0 | 185.7 | 183.2 | |||||||||||||||||||||||||||

| Transfer from lotteries fund | 235.0(2) | — | — | — | — | |||||||||||||||||||||||||||

| Total revenue | $5,662.4 | $5,499.0 | $5,841.9 | $6,067.7 | $6,082.2 | |||||||||||||||||||||||||||

| Expenditure 1 health and community services | $2,564.8 | $2,544.4 | $2,578.3 | $2,728.9 | $2,835.6 | |||||||||||||||||||||||||||

| Education | 991.0 | 999.5 | 1,045.8 | 1,120.5 | 1,179.0 | |||||||||||||||||||||||||||

| Economic and resource development | 586.0 | 571.6 | 617.7 | 653.7 | 733.2 | |||||||||||||||||||||||||||

| Manitoba tax credit plans | 189.4 | 198.1 | 181.2 | 178.0 | 181.8 | |||||||||||||||||||||||||||

| Direct local government assistance | 116.6 | 121.9 | 120.1 | 137.5 | 108.0 | |||||||||||||||||||||||||||

| Public debt | 555.5 | 539.1 | 520.1 | 514.8 | 480.8 | |||||||||||||||||||||||||||

| Debt retirement fund | — | — | 75.0 | 150.0 | 75.0 | |||||||||||||||||||||||||||

| Consumer services, public protection and other government services | 501.3 | 420.3 | 627.4 | 553.3 | 526.6 | |||||||||||||||||||||||||||

| Internal reform – workforce adjustment and general salary Increases | — | 12.0 | — | — | — | |||||||||||||||||||||||||||

| Allowance for losses | 0.7 | 0.9 | 0.1 | (0.1) | 0.8 | |||||||||||||||||||||||||||

| Total expenditure | 5,505.3 | 5,407.9 | 5,765.7 | 6,036.6 | 6,120.8 | |||||||||||||||||||||||||||

| Less: year-end savings | — | — | — | — | 60.0 | |||||||||||||||||||||||||||

| $5,505.3 | $5,407.9 | $5,765.7 | $6,036.6 | $6,060.8 | ||||||||||||||||||||||||||||

| Operating fund deficit (surplus) 3 4 5 | $(157.1) | $(91.1) | $(76.2) | $(31.1) | $(21.4) | |||||||||||||||||||||||||||

| Extraordinary items 6 | — | (264.6) | — | — | — | |||||||||||||||||||||||||||

| Operating fund deficit (surplus) after extraordinary items | (157.1) | (355.7) | (76.2) | (31.1) | (21.4) | |||||||||||||||||||||||||||

| Net changes in special funds 7 | 157.1 | (4.3) | 12.2 | 31.1 | 21.4 | |||||||||||||||||||||||||||

| Non-cash items included in deficit (surplus) | 132.3 | 164.1 | (268.5) | (58.4) | — | |||||||||||||||||||||||||||

| Provision for sinking fund | 390.8 | 694.2 | 512.5 | 628.2 | (29.1) | |||||||||||||||||||||||||||

| Net change – loans and investments | 167.5 | (643.9) | 83.2 | 287.8 | 1,029.8 | |||||||||||||||||||||||||||

| Decrease (increase) in liability to trust funds | (149.1) | — | — | — | — | |||||||||||||||||||||||||||

| Net cash requirement | $541.5 | $(145.6) | $263.2 | $857.6 | $1,000.7 | |||||||||||||||||||||||||||

| Provincial financing funded debt proceeds (net of repayments) for general government programs | $(22.8) | $72.9 | $(25.4) | $214.0 | $313.3 | |||||||||||||||||||||||||||

| For The Manitoba Hydro-Electric Board | 266.0 | (0.8) | 462.6 | 370.4 | 876.4 | |||||||||||||||||||||||||||

| For other self-sustaining programs | (136.7) | (43.7) | 36.1 | 53.1 | 153.4 | |||||||||||||||||||||||||||

| Decrease (increase) in cash and equivalents | 435.0 | (174.0) | (210.1) | 220.1 | (342.4) | |||||||||||||||||||||||||||

| Total provincial financing | $541.5 | $(145.6) | $263.2 | $857.6 | $1,000.7 | |||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||